Lawrence Yun, Chief Economist and Senior Vice President of Research at the National Association of Realtors (NAR), stopped by Silverthorne recently to give us an economic update. This was my first time hearing him speak and I was quite impressed. In about an hour he gave us a good understanding of the current economic conditions relating to housing. He didn’t just spout off statistics, although he did produce a lot of charts, but presented the information in a way that connected the dots, tying it all together in an easily understandable presentation. Because he works for the NAR I thought his presentation might be jaded to show housing in the best light possible. I saw it as an honest portrayal of where we are economically.

Lawrence Yun, Chief Economist and Senior Vice President of Research at the National Association of Realtors (NAR), stopped by Silverthorne recently to give us an economic update. This was my first time hearing him speak and I was quite impressed. In about an hour he gave us a good understanding of the current economic conditions relating to housing. He didn’t just spout off statistics, although he did produce a lot of charts, but presented the information in a way that connected the dots, tying it all together in an easily understandable presentation. Because he works for the NAR I thought his presentation might be jaded to show housing in the best light possible. I saw it as an honest portrayal of where we are economically.

Here are some of the things that stood out to me during his presentation:

Nationally, GDP is around 2% instead of our average rate of 3%. Business are keeping profits instead of reinvesting and business borrowing is lower. The economy is still growing but at a slow pace.

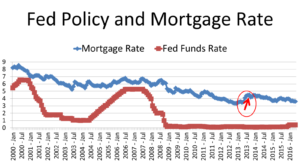

Mortgage rates are still low but expect them to start to rise. The Fed will begin to consistently raise rates. That won’t directly impact mortgage rates, but is one factor. Another factor is inflation. We will begin to see inflation rising in 2016. The low gas prices have kept inflation numbers at 0 but that won’t continue. Once the inflation we have already seen is no longer negated by falling gas prices we will see inflation rise. When the inflation rate is around 2 or 3% mortgage rates will rise too.

Mortgage rates are still low but expect them to start to rise. The Fed will begin to consistently raise rates. That won’t directly impact mortgage rates, but is one factor. Another factor is inflation. We will begin to see inflation rising in 2016. The low gas prices have kept inflation numbers at 0 but that won’t continue. Once the inflation we have already seen is no longer negated by falling gas prices we will see inflation rise. When the inflation rate is around 2 or 3% mortgage rates will rise too.

Our national debt and printing of money typically sparks inflation. This time around other countries are suffering more with huge debt, negative interest rates and governments pushing their economies along. Even though we are not doing great, we are better than a lot of others so our dollar is staying strong which is holding back even more inflation.

Some areas of the country are seeing record increases in housing prices. San Francisco’s huge increases are helping places like Denver and Seattle as those that can no longer afford San Francisco seek out employment and housing in lower priced areas. As a result, slowing in the San Francisco market will also impact other housing markets across the country. Because Denver is a huge feeder market for our Summit County second home market, slowing in Denver’s market will eventually slow the Summit County market. It’s a trickle down effect.

Fewer young people are entering the housing market. Many are still living at home with mom & dad trying to pay off college debt and avoiding high rents. They still dream of home ownership but it is further down the road for young people than it has been in the past.

Overall the economy is doing ok. At some point all of these things will catch up with us. The only question is when. It’s extremely difficult for anyone to say how long we can balance on the edge of this cliff before tumbling off. It could be one more year or ten. All you can do is make sure you are comfortable with your current situation and where you see your future. Be confident that if the economy goes over the edge, you will still have some stability in place and can manage to climb down slowly if needed.

Overall the economy is doing ok. At some point all of these things will catch up with us. The only question is when. It’s extremely difficult for anyone to say how long we can balance on the edge of this cliff before tumbling off. It could be one more year or ten. All you can do is make sure you are comfortable with your current situation and where you see your future. Be confident that if the economy goes over the edge, you will still have some stability in place and can manage to climb down slowly if needed.

Leave a Reply