The first quarter of 2024 is over. It looks like the craziness of the pandemic market is behind us now. Summit County went from around 1,800 pre-pandemic, real estate sales a year to just over 2,100 during the pandemic. Then dropping to 1,300 sales a year practically overnight in 2022 and 2023 when interest rates sky rocketed. However, after seeing the first quarter of Summit County, real estate sales match closely to 2019’s first quarter, it brings up the question: are we back to pre-pandemic real estate activity?

Pre-pandemic real estate activity

Between 2015 and 2019, the Summit County real estate market was stable with sales hovering around 1,800-1,900 sales per year. Looking at the 12 months ending March 31, 2020, right up to the start of the pandemic, there were 1,798 residential sales as expected. The average sale price back then was $819,810. It took, on average 59 days for homes to go under contract and they sold for an average of 97.8% of list price. 26.6% of those sales were cash sales, without a mortgage.

Pandemic real estate sales activity

Then during the pandemic, the 12 months ending March 31, 2022, the number of sales jumped up to 2,028. Average sale price was up to $1,193,734. It took 22 days on average for homes to go under contract. Those homes were selling for an average of 101.2% of list price. Even with a lot of competition for homes, incredibly low interest rates kept cash sales just a touch higher at 29.8% of transactions.

Current real estate sales activity compared

Fast forward to the 12 month period ending March 31, 2024. There have only been 1,285 sales. That is quite a bit lower than the pre-pandemic normal. I believe the double whammy of higher interest rates and higher prices are to blame for that.

However, if we focus on the first 3 months of 2024 and compare that to the first 3 months of 2019, it tells a different story. In the first quarter of 2019, there were 271 residential sales in the county. 2024’s first quarter was 11% lower with 242 residential sales. That’s much better than the 28.5% decrease when comparing the previous 12 months of sales. Could the uptick in sales happening so far this year be a sign of things to come in 2024? If we dig into additional statistics for the first quarter there are even more similarities.

So far this year, homes are taking just under 60 days on average to sell. Slightly faster than 2019 when it was just over 60 days. The median, however, is the same for both years at 23. Looking at this in a slightly different metric, of the 242 sales this quarter, 61% of those sold in the first 30 days they were on the market and 75% sold in the first 60 days. Those are the same percentages as 2019’s first quarter.

Buyers are paying, on average, 97.6% of list price for properties during the first quarter of 2024. During the same period in 2019, the average was 98.1%. Yet another similarity.

The high interest rates have really pushed the number of cash sales up. 48.8% of the first quarter sales were cash. Compare that to 26.1% in Q1 2019. Interest rates are substantially higher than they were in the pre-pandemic real estate market so it makes sense that cash sales would be too.

As we all know, average sale price isn’t and probably will never be back to 2019 prices. Average sale price is up to $1,396,058 in the first quarter of 2024. That’s a 62.9% increase over Q1 2019. With more than half of the sales over one million dollars so far this year, it’s no surprise to see the average sale price up there too.

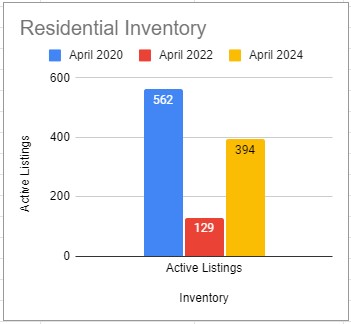

Inventory for sale pre-pandemic, pandemic, and current

The number of homes on the market is evaluated as a number at a fixed point in time rather than an average over a time period.

On April 12, 2020, at the beginning of the pandemic, there were 562 homes on the market. That’s a 3.8 month supply of homes and considered a seller’s market.

During the pandemic, on April 8, 2022, there were 128 homes for sale in Summit County. That’s less than a month supply of homes and an extreme seller’s market.

Currently, on April 6, 2024 there are 394 homes on the market. That’s about a 3.7 month supply, again, a seller’s market.

April 2024 has a fewer homes on the market than in April 2020. But because of slightly lower demand it will take the same amount of time for the market to absorb them. Absorption rate is one of the key factors to look at when assessing the market.

Is pre-pandemic real estate activity back?

So back to the question in the title of this post. Will 2024 real estate activity wind up more like 2019 when it’s all said and done? We are hopeful. I don’t expect there to be as many sales. Inventory should increase over the summer months, that’s typical. That increase will give buyers more choices but probably not enough to shift the market from a seller’s market to a buyer’s market. A high mortgage payment coupled with higher property taxes and insurance rates will help to keep demand lower. If interest rates come down by this fall, which is looking more and more unlikely, that could certainly increase demand and propel sales numbers higher. 2024 is also an election year. The presidential election can cause uncertainty for many, potentially putting people in limbo and keeping them from buying or selling real estate.

Based on the first quarter numbers, I expect 2024 to see more real estate activity than 2023. I do not expect it to be quite the caliber of 2019 though. This should still bring us one step closer to a healthier, consistent market, which is a good step to make.

Leave a Reply